Business Groups Seek Electric Rate Breaks as PSC Repurposes $925 Million/Year Surcharges

Consumer groups have urged the New York Public Service Commission to improve low-income rates in its “Revising the Electric Vision (REV)” proceeding to overhaul its regulation of the electric industry. See AARP AND UTILITY PROJECT REPLY COMMENTS HIGHLIGHT CUSTOMER PROTECTION, AFFORDABILITY IN NY PSC REVISED ENERGY VISION “REV” CASE, October 29, 2014, AARP AND UTILITY PROJECT FILE COMMENTS ON NY PSC STAFF TRACK I “STRAW PROPOSAL” IN “REV” PROCEEDING, September 22, 2014. Specifically, there is a call to adopt a more robust low-income rate program along the lines of California’s CARE program, as is suggested in the 2014 New York Draft State Energy Plan.

An excellent opportunity to implement new measures to improve low-income rates in the REV process is presented by the PSC’s effort to repurpose electric bill surcharges that will yield revenue of $925 Million in 2015. In part to free up previously committed funds for proposed new “Distributed Energy Resource (DER)” programs, the PSC proposes to convert the existing narrowly targeted surcharges for energy efficiency programs and renewable energy subsidies into a new surcharge for a “Clean Energy Fund (CEF)” that would more flexibly allocate billions of dollars in the future. Consideration of rate relief for low-income customers should not be off the table in this context because, as discussed in detail below, the PSC is considering a request from large industrial customers to reduce their rates in the same case.

Part of the CEF proposal is to phase down over time the amount of revenue being collected through the surcharges. But instead of reducing the surcharges to the extent proposed in the creation of a new combined purpose CEF surcharge, which may yield only a slight general bill reduction to all customers, the surcharges could be reduced less and some of the revenue used to reduce bills significantly for low-income customers. Thus, we have proposed calling the CEF a “Clean Energy and Affordability Fund.” As proposed by the PSC and NYSERDA, however, the CEF surcharge reform would not address the affordability crisis for low-income customers. See ELECTRIC BILL SURCHARGE REFORM PROPOSALS TO COLLECT AND SPEND BILLIONS DO NOT ADDRESS AFFORDABLE SERVICE TO LOW INCOME CUSTOMERS, November 12, 2014.

Other parties have not in their public comments supported this effort to make essential utility service affordable to low-income customers. Indeed, despite overwhelming evidence that Con Edison rates are not now affordable to many low-income consumers in New York City, New York City’s July comments in the REV case ignore the affordability problem. Incredibly, New York City says only that the PSC should ensure in implementing REV that electric service “remains affordable” when manifestly it is not affordable now to many New York City residents. But the most recent data available to us indicates that as of August, 2014:

- 286,143 Con Edison residential customers (11% of the total) were more than 60 days overdue in paying their bills

- They owed $258.9 million to the utility, much of which was subject to 18%/year late charges

- Con Edison sent shutoff notices to 8.2% of its residential customers in August 2014, and sent 2.8 million shutoff notices in the 12 preceding months

- Con Edison shut off service to 82,602 residential customers as a bill collection measure in the preceding 12 months

In comparison to 2005, before the Great Recession, in August 2014 the percentage of Con Edison customers late in paying more than 60 days is up approximately 22%, and the amount of 60+ day arrears they owe is up approximately 143%. The number of customers with Deferred Payment Agreements (DPAs) — which allow customers to pay installments on arrears with current bill payments — is up more than 40%, to 452,500. These customers are at heightened risk of shutoff if they miss or are late in making a payment on the DPA.

The August 22, 2014 DPS Staff REV Track 1 Straw Proposal minimally acknowledges concerns expressed by consumer groups regarding “the incidence of service disconnections and bill arrears.” But DPS Staff proposes no measure to address them. Instead, Staff merely said “existing utility bill relief goals and customer protections” should be “maintained. ” We recall similar blithe assurances of benign results when the original PSC “Vision” to restructure the utility regulation paradigm was adopted without legislation in Opinion 96-12: affordability of service to low-income customers – a principle then supported broadly by stakeholders – was rejected as an express goal because under the “Vision” all rates, including those for low-income customers would be assumed to be “just and reasonable;” consumer protection was claimed by the PSC to be “paramount” even while HEFPA was ignored for new providers, the “ESCOs” (which resemble the new breed of ambiguous entity in the REV case, labelled as “DER providers). The results of the first “Vision” have been disastrous for low-income customers — spiking electricity prices, massive shutoff notices, erosion of consumer protections, ESCO price gouging abuses, nonenforcement of HEFPA, high arrears, and large numbers of actual service shutoffs. Long overdue consumer protection reforms of the ESCO regulatory regime have been stayed pending the outcome of the REV case, but there is no resolution proposed by Staff in its Straw Proposal that would protect customers adequately in their dealings with ESCOs or DERs. Thus, as proposed by Staff, for low-income customers the “reformed” REV “Vision” isn’t demonstrably different from the original nightmare.

New York City’s Comments on the Staff REV Track 1 Straw Proposal did not question or challenge DPS Staff’s proposal essentially to do nothing new on bill affordability to low-income customers or customer protection in the new DER regime. Instead, echoing the original 1996 PSC “Vision” , New York City advocates only for a ” continued focus on just and reasonable rates”, with no express mention or concern for affordability, and actually argues for reduced regulatory oversight of ESCOs.

Meanwhile, the PSC is considering, as a measure to implement its REV policies, creation of the CEF. In that proceeding it will act on a Petition of Multiple Intervenors for Expeditious Relief from Existing Surcharges which seeks to disproportionately lower rates of large industrial and commercial customers, by reducing the surcharges for them, at the likely expense of other customers. On many past occasions Multiple Intervenors has opposed proposals for low-income rate enhancement that would result in a minor shift of costs to them. Several utilities have objected to the Multiple Intervenors’ Petition. The City of New York, however, has not opposed the Petition of Multiple Intervenors for rate relief, and has not objected to the lowering of their members’ rates, which would occur at the probable expense of other customers, including low-income customers, if the same amount of revenue is to be raised without equal contribution by Multiple Intervenors. The law firm representing the City of New York in the REV case, where the City is not supporting rate relief for low-income customers, is the same law firm that represents Multiple Intervenors in the CEF case, where the City is not opposing the Multiple Intervenors request for a rate reduction.

Background: The PSC Ordered Electric Bill Surcharges

The PSC decided to levy a “System Benefits Charge” when it adopted its Opinion 96-12 “Vision Order for restructuring the New York electric industry and the state’s regulatory regime. The “Vision Order” was implemented through plans adopted in subsequent “rate/restructuring” settlement agreements with each of the major investor-owned utilities. (The utilities basically agreed to divest power plants in conformance with the “Vision Order” in exchange for authorization to reorganize into holding companies and long term rate plans). The new “System Benefit Charge” was described at pages 61-62 of the “Vision Order”:

A system benefits charge would provide a funding source during the transition, and possibly over the long term, for public policy initiatives that are not expected to be adequately addressed by competitive markets. It would be designed to ensure that the cost of carrying out these public policy initiatives was fairly allocated across most, if not all, users of the power distribution system, and recovered in a competitively neutral manner. Initially, the system benefits charge would be set at approximately the level of current utility expenditures, with the expectation that these charges will be closely scrutinized with respect to their impacts on rates. Programs funded in this way, along with the innovative programs likely to be developed by energy service companies, provide ample reason to be confident, as we are, that cost-effective energy conservation measures, including demand side management, will flourish in the new environment. We anticipate the levels of energy efficiency programs accomplished in this way will be higher than existing levels. In light of the potential benefits, a system benefits charge should be put in place during the transition to retail competition. The use of a system benefits charge should be revisited sometime after retail competition has commenced to determine whether the level of these programs is sufficient and whether the continued use of a system benefits charge is required. To ensure that funding is provided consistent with our policy and that any fund is administered properly, we will continue to oversee these programs.

At the time, the investor-owned utilities, through their Energy Association, objected “to a system benefits charge and to any other mechanism that uses utility rates to fund programs more appropriately funded through the market place or taxes. Multiple Intervenors, representing big business customers, said it “totally opposes such a fund, claiming the market can and should provide any needed funding for environmental and public policy programs.” The now-defunct Consumer Protection Board objected to “using rates, through a system benefits charge or other means, to fund environmental or public policy programs more appropriately funded through the market place or taxes. “ CPB, however, also said “other public policy objectives (including low-income assistance and rural access) should be funded by a system benefits charge.” When the Commission decided the details of the SBC in Opinion 98-3, the Utility Project urged that incremental revenue raised with the surcharges be used for added “low income energy efficiency and energy management programs. . . . [and] that other low income programs, such as rate discounts, should not be funded through this charge, but instead should be part of [base] rates.” The passage of time raises questions about the correctness of that judgment. While some progress has been made incrementally since then in incorporating low-income rates into the base rate structure, the PSC has resisted adoption of the more robust low-income rates that provide deeper rate reductions to more eligible customers, like the California CARE rates mentioned in the Draft State Energy Plan. The reticence does not appear to be based on a finding that the rates are affordable to the poor, but upon reluctance to make the necessary shifts of revenue responsibility to other non low-income customers, in the context of cases where rates are generally being raised. Also, Multiple Intervenors generally opposed proposals to reduce rates for low-income customers if it meant large customers would pay more.

In contrast to new York, California’s Alternative Rates for Energy (CARE) program utilizes a surcharge to support its low-income rates and exempts low-income customers from paying that and other surcharges, such as the one which pays for rooftop solar subsidy programs. This approach appears to be working well. The PSC reviewed and renewed and enlarged the SBC through several orders since the Vision Order adopting it in 1996 and Opinion 98-3 spelling out the details. A history of SBC I, II, and III can be found on PSC’s SBC web page. Under the SBC I Order, initial funding totaled $234 million from 1998-2001 ($78.1 Million/year) for energy-efficiency programs, R&D projects (including renewables), low-income energy assistance (including weatherization), and environmental disclosure activities. The PSC SBCII Order summarized Multiple Intervenors’ opposition, which claimed that

“the Staff Proposal fails to demonstrate a need for the programs, fails to recognize that the increase in demand in the southeastern part of the State is the result of economic growth rather than from the waste of energy, fails to recognize that the SBC will increase the price of electricity for all consumers while disproportionately impacting large commercial and industrial customers upstate, fails to demonstrate that SBC programs have produced quantifiable results, and fails to demonstrate that it will reduce energy consumption downstate.”

In the SBCII Order, Multiple Intervenors’ objections were rejected. Indeed, the SBC fund was nearly doubled, from $78.1 Million a year to $150 Million a year. In December 2005 the PSC again considered extending the SBC in the SBC III proceeding. Again, Multiple Intervenors opposed the SBC. As the PSC noted in the SBC III Order,

Out of the approximately 140 responses received, the only opponents to renewal of the SBC program appear to be Multiple Intervenors and the Business Council.[FN] Multiple Intervenors would like to see the program eliminated, or at least phased-out over a five year period. The gist of its arguments in opposition is that the SBC increases the price of electricity for all consumers, which it claims disproportionately impacts large commercial and industrial customers upstate. The Business Council has a long¬standing opposition to the SBC program.”

In footnotes, the PSC stated that “Multiple Intervenors is an unincorporated association of approximately 55 large commercial and industrial electric customers, and that “Membership in The Business Council of New York State, Inc. is made up of large multi-national corporations, banks, other large companies and consulting firms, and a majority of New York’s investor-owned gas and electric utilities.” This opposition from big businesses was rejected by the PSC, and the SBC program was extended yet again. Indeed, the SBC III Order raised the SBC from $150 Million/year to $175 Million/year, through 2011. This brought total 1998 – 2011 funding to $1.89 Billion. In December 2010 a six month extension of the existing SBC III added roughly $90 million to this total. In October 2011, the PSC again considered the SBC in its SBC IV Order which shifted the activities and programs away from some areas that had previously been funded by the program. In that order, it created a new program and transferred certain SBC portfolio programs to a new Energy Efficiency Portfolio Standard (EEPS) program administration. Total SBC funding for the programs transferred to the EEPS portfolio (about $98 million) and the new Technology and Market Development Program (T&MD) portfolio, about $82 million, was authorized at the same SBC III funding level of approximately $180 million annually for each of the five years ending December 31, 2016.

The RPS In 2004, the Commission established another, and now far larger surcharge for the State’s Renewable Portfolio Standard (“RPS”), in order to develop renewable energy in the State through surcharges paid by the State’s electric customers. Collections from customers for these three surcharge programs have grown through various Commission authorizations from $75 million annually when the SBC first began to $925 million annually in 2015. The description of the RPS and links to RPS orders are at the PSC web page for the RPS.

The Pending Proposal to Repurpose Existing SBC/EEPS/RPS Surcharges and Create a New “Clean Energy Fund (CEF)” An integral part of the New York Public Service Commission’s “Reforming the Electric Vision (REV)” initiative is the proposed repurposing of the existing surcharges. By Order issued May 8, 2014, the Commission instituted a proceeding to consider morphing the existing programs, surcharges and funds into a new “Clean Energy Fund.” The PSC asked NYSERDA to develop and submit a Clean Energy Fund proposal for Commission consideration. The NYSERDA Clean Energy Fund Proposal filed September 23, 2014 proposes to reduce the total surcharges and to allow funds to be used for business development purposes which are not perfectly clear. NYSERDA asserts in its proposal that

“First, the CEF seeks to achieve greater levels of scale for clean energy in the State economy. Second, the CEF will be oriented to achieve scale, not only through the investment of public funds, but to foster new investment opportunities to attract private capital to invest in clean energy in New York. Initiatives oriented for scale and private capital attraction will then result in the third desired outcome: significant reduction in greenhouse gas (GHG) emissions from New York’s energy sector. To achieve these long-term outcomes the CEF’s theme is “market transformation,” and the CEF will employ approaches that will enable the entire clean energy supply chain – from technology developers to equipment wholesalers to financial institutions to building managers and construction contractors as well as to energy consumers seeking clean energy options – to create a new, integrated, self-sustaining clean energy market.”

NYSERDA’s proposal says it “recognizes that high overall energy costs in New York State create a cost burden on all customer classes – residential, commercial, and industrial.“ Currently, annual collections for existing utility clean energy programs, including the State’s energy efficiency and renewable energy programs, total $855 million in 2014 and $925 million in 2015, the bulk of it now for renewables. The NYSERDA proposal is to cap the total surcharge revenues at $700 million in 2016, and phase them down in stages. falling to $453 million, $428 million, and $308 million per year in 2019, 2021, and 2025, respectively. As we previously observed, NYSERDA’s proposal contains no specific rate relief for low-income customers. See ELECTRIC BILL SURCHARGE REFORM PROPOSALS TO COLLECT AND SPEND BILLIONS DO NOT ADDRESS AFFORDABLE SERVICE TO LOW INCOME CUSTOMERS November 12, 2014.

Currently, the Niagara Mohawk d/b/a National Grid residential surcharge is $.008239 per kWh, i.e., just under one cent per kWh. A residential customer using 335 kWh would now pay approximately $2.76/month. If the surcharges are ratably reduced as proposed by NYSERDA, the surcharge paid would go down $0.67/month in 2016. By 2025, the surcharges would be lower by $1.84/month . Rather than slightly lowering the charges for all customers, we have suggested using part of the current surcharge revenues to help implement a California type robust low-income rate program that reduces low income customer bills by 30-35% to all eligible customers. This would help address the current affordability crisis. See CATCHING UP IS HARD TO DO; and MANY CENTRAL HUDSON CUSTOMERS IN DEBT, FACING HARDSHIPS, LATE CHARGES, SHUTOFF THREATS, AND SHUTOFFS OF ESSENTIAL UTILITY SERVICE.

NYSERDA’s Clean Energy Fund Proposal claims to have involved “stakeholders”in its development. But the Appendix A to its Proposal indicates that those consulted were mainly provider entities that now get money from the existing surcharges, utilities, weatherization providers and environmental groups. The list of organizations consulted by NYSERDA in determining what to do with its $925 Million annual surcharge revenues and programs does not list any independent organization representing ordinary residential customers or low-income customers, and does not include any state legislators.

Multiple Intervenors’ Petition to the PSC for Relief from Surcharges On June 2, 2014, Multiple Intervenors filed a petition asking the PSC to grant relief to its members from the current NYSERDA surcharges, on behalf of its large customer members. Multiple Intervenors asks the PSC to give large high load factor customers immediate rate reductions with unspent NYSERDA surplus funds.

“This extraordinarily large surplus begs the question – why not implement an immediate and substantial reduction in the Existing surcharges designed to provide much-needed relief for large, high-load-factor customers? It is unconscionable for such customers to be saddled with the burdens associated with the Existing Surcharges, as illustrated above, when NYSERDA is projecting a cash balance for those programs of almost $700 million as of March 31, 2015.

Petition of Multiple Intervenors for Expeditious Relief from Existing Surcharges, June 2, 2014; Case 10-M-0457 In the Matter of the Systems Benefit Charge IV, Case 07-M-0548 Proceeding on Motion of the Commission Regarding an Energy Efficiency Portfolio Standard, Case 03-E-0188 Proceeding on Motion of the Commission Regarding a Retail Renewable Portfolio Standard, filed June 2, 2014. The Petition seeks immediate relief from the Systems Benefit Charge (“SBC”), Renewable Portfolio Standard (“RPS”), and the Energy Efficiency Portfolio Standard (“EEPS”) (collectively, “Existing Surcharges”). The Petition proposes various options to achieve the requested relief including: (1) implement a material reduction in the level of Existing Surcharges; (2) modify the current recovery methodology such that Existing Surcharges are no longer recovered from customers solely on a per kWh basis; (3) implement a “cap” or “ceiling” on the amount of Existing Surcharges that could be assessed to a single customer in a given month or year; or (4) create a hybrid of the above proposals by utilizing some of the existing surpluses to reduce the Existing Surcharges for all customers, and also (i) modify the current per kWh recovery methodology and/or (ii) implement a cap on the amount of Existing Surcharges that can be assessed to individual customers.

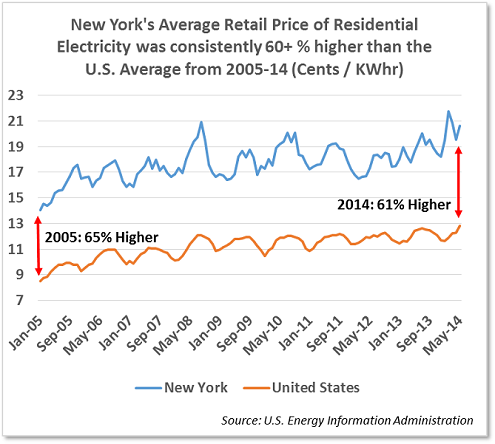

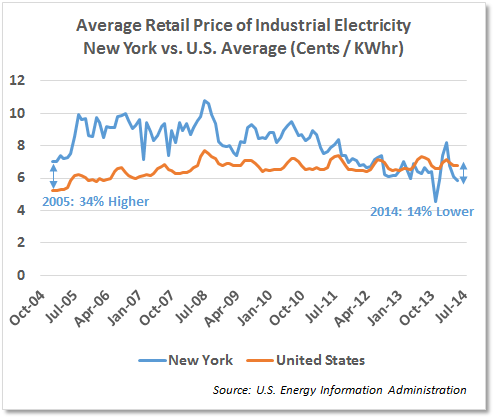

Multiple Intervenors’ Petition, supported by Comments of the Business Council, asserts hardship and puts forward anonymous examples of companies whose surcharges are large in proportion to their delivery rates. Some of Multiple Intervenors’ members, however, get steeply discounted “negotiated” utility rates, through the PSC, even if the utility does not agree in “negotiations”, as has occurred with large industrial customers like Nucor and Corning. Those discounts, where warranted, are already calibrated, or could be recalibrated, if there is truly a demonstrated hardship by a needy industrial customer. Also, numerous Multiple Intervenor members receive hydropower allocations from the Power Authority, including cheap hydropower worth more than $100 million/year that once was provided to residential customers. While residential New York customers pay rates more than 60% higher than the national average, rates for industrial customers are now significantly less than the national average:

Giving Multiple Intervenors a rate break as they have requested, without considering hardship to low-income residential customers and whether rate relief to them is warranted, would not be reasonable or equitable.

Giving Multiple Intervenors a rate break as they have requested, without considering hardship to low-income residential customers and whether rate relief to them is warranted, would not be reasonable or equitable.

Indeed, what Multiple Intervenors is proposing for all its members based on possibly cherry picked data may be unlawfully discriminatory, or an “undue preference and advantage in violation of subdivisions 2 and 3 of section 65 of the Public Service Law,” Lefkowitz v. Public Service Commission, 40 N.Y. 2d 1047 (1977). The statute says a utility may not grant any undue or unreasonable preference or advantage to any person, or to any particular kind of service in any respect whatsoever, nor may any person or particular type of service be subjected to any undue or unreasonable prejudice or disadvantage in any respect whatsoever.

Comments filed by utilities generally opposed Multiple Intervenors’ petition, arguing that procedurally it should be considered not on a stand alone basis but in the CEF proceeding, which the PSC has now done. Making an interesting point, Con Edison observed in its comments that some of the functions now funded with the surcharges might in the future be funded with revenue from the RGGI greenhouse gas markets. If that were done, additional CEF funds could be freed for use in a reformulated Clean Energy and Affordability Fund, as we have urged.

No SAPA comments were filed on the obscure Multiple Intervenors’ Petition by any representative of small consumer groups. The PSC consolidated the petition for surcharge relief into the Clean Energy Fund (CEF) case, and may continue to receive comments on it now that it is brought into the CEF proceeding and its schedule. The Commission should reject the Multiple Intervenors Petition, but should also consider using repurposed surcharge revenues to provide more meaningful rate relief to low-income residential customers. Instead of slightly lowering rates to all customers they could be lowered less in order to enhance statewide low-income rate reductions and broader participation of eligible customers. Also, low-income customers should be exempted from the surcharges for programs which do not generally provide much in the way of participant benefits to low-income customers, as California does with its CA-Sun solar surcharge.

The case schedule for determining how billions of dollars will be collected from ratepayers and expended in then coming years is on a fast track. On November 8, 2014, the PSC issued a Notice Solliciting Comments requiring NYSERDA to refine its proposal and to file it by November 17, 2014. The key dates for the CEF case are as follows:

- November 17, 2014 – NYSERDA files 2015 Reallocation Supplement;

- · December 8, 2014 – Initial comments filed on NYSERDA CEF Proposal to reallocate EEPS and SBC funds for continuation of programs in 2015 and NYSERDA 2015 Reallocation Supplement;

- · December 22, 2014 – Reply comments filed on NYSERDA CEF Proposal to reallocate EEPS and SBC funds for continuation of programs in 2015 and NYSERDA 2015 Reallocation Supplement.

The surcharges could be maintained – or reduced less than proposed — in order to provide much needed rate relief to New York’s low-income electric customers. The PSC has a rare opportunity to enhance New York’s low-income rates without raising bills to other customers that should be seized.

Gerald A. Norlander

Follow New York’s Utility Project on Twitter