The Crisis of Unaffordability and a Proposed Legislative Fix to Lower Electric and Gas Rates for New York’s Low Income Utility Customers

I. The Crisis of Unaffordability

New York electric utility rates for residential customers are 59% higher than the national average. That is simply not affordable for many customers who cannot now afford essential utility service without hardship.

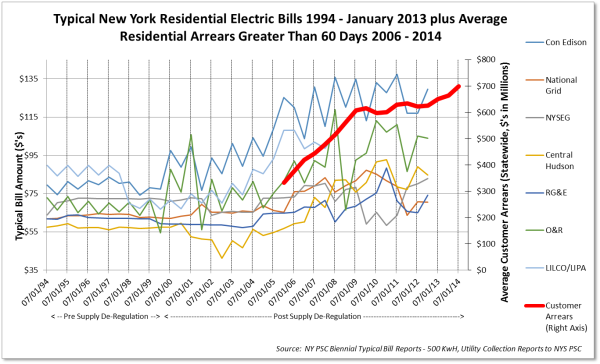

The result of New York’s unaffordable electric rates is that increasingly, customers have fallen behind in paying their bills. As the chart below shows, those who are more than sixty days in arrears now owe the utilities approximately $800 million.

In 2014, New York State’s electric and gas utilities issued 7.2 million shutoff notices and shut off service to approximately 300,000 customers as a bill collection measure. The largest energy utility, Con Edison, issued 2.8 million shutoff notices and shut of service to 82,000 customers in 2014.

The IP address 192-168-1-1 is the default IP address of the router from certain brands like TP-Link 192168ll Netgear, Linksys, and ZyXEL. But keep in mind that it is also not necessary that 192-168-1-1 will be the default IP address all the time

Shutoff notices place many customers with unaffordable bills in jeopardy of losing essential utility services. In addition to causing significant stress and worsening financial circumstances, utility shutoff threats and actual shutoffs may spiral into crisis situations, dangerous conditions, loss of life or other serious harm to customers and their neighbors.

New Year is praised on first January on every year. On 31st December evening, individuals will love with gatherings, qualities, and exciting diversion. happy new year 2018 images Youth will begin their readiness for New Year festivities. New Year festivities have turned into a piece of our way of life.

The Draft New York State Energy Plan issued in 2014 recommends that New York follow California’s lead by adopting low-income rates to improve affordability of electric and natural gas rates. The California Alternative Rates for Energy (CARE) program substantially reduces bills for lower income customers with funding from California “Public Goods Charge,” which also supports energy efficiency and renewable energy programs. California also has a Family Electric Rate Assistance Program (FERA), which provide lesser reductions for customers with incomes slightly above CARE program limits.

The PSC has underway a proceeding to consider the affordability issues, and a PSC Staff proposal for a four-tier low-income rate program was recently issued. While this represents an important step, the staff proposal would not have the impact of the California type program.

Comments to the PSC on the staff proposal in Case 14-M-0565 are due August 3, 2015. Interested parties can submit public comments by sending email with “Case 14-M-0565” in the subject, to PSC Secretary Burgess at secretary@dps.ny.gov.

II. A Proposed Bill to Lower Rates for Low and Fixed Income New Yorkers

A bill was recently introduced in the New York Senate to require the utilities and the Public Service Commission to implement low-income rates similar to California’s (see, New York Senate Bill 5819 -2015). The bill would require rate reductions of 25% – 35% for customers receiving income-tested benefits such as any customer who receives benefits from Supplemental Social Security for the Aged or Disabled, Temporary Assistance to Needy Families, Safety Net Assistance, Supplemental Nutrition Assistance (SNAP), medical assistance, Home Energy Assistance (HEAP), telephone Lifeline Assistance and any additional programs or higher income standards approved by the Public Service Commission (PSC). This would ensure minimum statewide inclusion of customers found eligible for other need-based assistance, and would enable the PSC to create additional programs such as California’s FERA. In contrast, New York’s current low-income rate programs have varying benefit levels and eligibility tests, based on rate case settlement proposals approved by the PSC. The bill encourages cooperation between the PSC, utilities, and social services officials to achieve full and efficient enrollment of eligible customers.

RobTop, the company of the owner himself, published the game. Geometry Dash Apk This game is played all over the world and in the game, you will see that there are officially 21 levels whereas you can create your level too

The bill would require the PSC to mitigate the revenue impact of reducing bills of low income customers by (i) applying any earnings of the utility above the allowed return on equity set in the most recent rate case,

(ii) disallowing any premium above the rate of return allowed for not filing a rate case or for sharing of over earnings,

(iii) utilizing any uncommitted funds available from current surcharges allowed by the commission

(iv) disallowing recovery from ratepayers of any costs of executive compensation bonuses.

In recognition that affordable rates for low income customers is a universal service principle that benefits all, the bill requires that any shift of revenue responsibility to other customers due to the low-income rates shall not be borne solely by any single class of customer.

Gerald Norlander